We specialize in helping high net worth individuals manage the financial complexities that they face over their lifetime. That’s what makes us unique. We help them manage their finances to ensure long term prosperity.

These complex financial issues often require expertise in a variety of financial areas. We combine our personal experience working with high net worth individuals with the input from professionals available to us through iA Private Wealth Inc. and associates in the professional community.

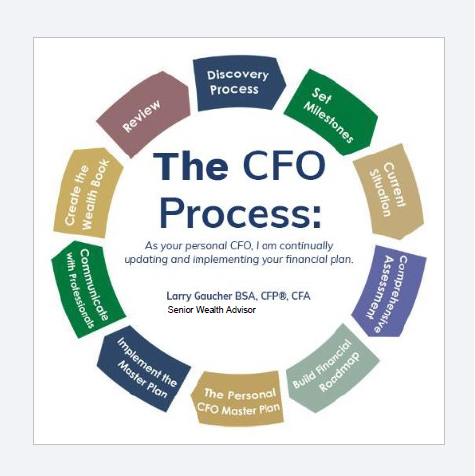

Our approach is to act as your personal Chief Financial Officer (CFO) to help you make wise financial decisions. We have expertise in financial issues that wealthy individuals face. As your personal CFO, we are continually updating and implementing your financial plan.

Discovery Process →

Our first meeting provides an opportunity to explore whether our approach is a good fit with your situation. We will ask questions about your financial goals and what is important in your life. Also, we’ll explain how we use the the CFO process to help advise our client’s entire financial situation.

Set Milestones →

As with any plan, progress comes faster when you have a goal to work towards. We’ll help set financial goals that make sense given the personal and business information we revealed in the Discovery Process.

Current Situation →

We will document your business and personal financial situation, allowing us to create a benchmark for measuring overall progress.

Comprehensive Assessment →

Before we develop a strategy, we must have a thorough understand of your situation. We will perform a comprehensive review of information relevant to your personal and business finances.

Build a Financial Roadmap →

At this point, we have established your personal and business financial goals and have established a solid understanding of your financial situation. Next, we’ll develop a Financial Roadmap to guide how we will work towards meeting those goals.

The Personal CFO Master Plan →

Based on our analysis, we’ll recommend strategies for tackling the complex issues you face. You’ll sleep better at night knowing that we’ve organized your financial affairs and taken care of important financial issues such as preparing for business succession and ensuring that you are not overpaying taxes. Development of this plan is complex and may require a few months to complete.

Implement the Master Plan →

At this point, you will see a direct impact on your financial situation. Many of the recommendations in the Master Plan are interrelated, and we will ensure that they are implemented in a logical and practical order.

Communicate With Professionals →

Complex financial issues often require expertise in areas such as tax planning, employee benefits, and succession planning. We will work with professionals in the community as required, including your current accountant and lawyer.

Create The Wealth Book →

To create peace of mind, we will compile a summary of your financial situation. The Wealth Book contains the CFO Master Plan that we have developed, along with other practical reference information relevant to your personal and business finances.

Review →

Sound financial management is a continuous process. We will meet with you periodically to review and revise the CFO Master Plan, ensuring we are always on top of your financial situation.